So far this year, we have seen a ravenous interest from U.S. investors in currency-hedged equity exposure. Currency risks have increased; currency volatility is on the up:

The reasons behind these trends can be understood in part via the nature of human psychology and power, and the reality of politics.

Consider yourself, for a brief moment, the ruler of a mid-ranking economy; the proud nation of Atlantis. As in many parts of the world, your ministers, media and constituents are lamenting a series of profligate governments. Mounting government and consumer debts are handicapping your hopes of Keynesian stimulus. Meanwhile, international economic agencies besmirch your national pride: your labour force is “uncompetitive”; they and your social policies are at chiefly fault for your stuttering, moribund economy.

The choices are difficult. You might impose drastic cuts in government services and raise taxes to “balance the books”, no doubt at the risk of further constraining the economy. Or you could heed those plaintive calls from the IMF and drastically reform the marketplace for labour and businesses, reforming the tax code along the way for good measure.

Both options may engender significant opposition from vested interests to whom you are grateful for your position in power. More certainly, such measures will cause abundant and vocal distress in the population.

I’m a politician – give me an easier option!

But what if you could simply debase your currency? If the rest of the world is prepared to pay one U.S. Dollar for what is currently worth three of your Atlantan Mickles, how much more competitive would you be if you could sell the same thing for $0.50? The answer seems obvious. Lower your interest rates! Print money! Your currency will soon be worth nothing!

Having a less valuable currency might dent national pride, but there’s plenty to compensate. Bond investors will benefit from falling yields; equity investors will celebrate your stimulus. And remember those large debts? They are suddenly cheaper (in USD terms) to repay and your low-low interest rates mean that everyone’s debt just got easier to service. Everyone’s a winner in Atlantis!

Sounds brilliant. Are there any risks?

As anyone who has paid but the briefest attention to the critics of such programmes will know, the risk to such financial magic is the devastating consequences of too-high inflation. Imports will immediately become more expensive, as will commodity prices in local terms. Simply put, your citizens will have to pay more for what they buy.

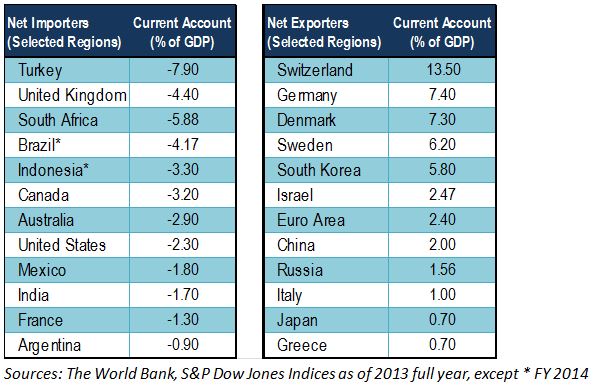

And for politicians, this is a uniquely acute risk: there are few historic errors of government more stimulating to revolutionary sentiment than hyper-inflation, particularly in the absence of a rapidly growing economy. One way of testing the extent to which your economy might be impacted by currency movements is to use the current account balance – a national measure which subtracts the value of imports from exports and accounts for other relevant financial flows (if you own property in the Bahamas and earn a rent on it, it is not an “export” but the income is nonetheless included in the current account balance). Here are the current account balances for a few major economies:

So, can I debase my currency then?