As we approach the holidays, I want our readers to note a couple of items that may affect the near-term performance of the municipal bond market.

First, as noted by The Weather Channel, approximately 200 million Americans have recently been caught up in a pre-winter polar vortex of snow and bitterly cold temperatures. Coincident with Mother Nature’s late autumn gift is the continued downward price pressure on oil. The spot price of Cushing, Oklahoma West Texas Intermediate (WTI) on the New York Mercantile Exchange dropped from $107.95 per barrel in June to its November 17 level of $75.64 per barrel, a 30% decline as spot prices hit a four-year low of $74.13 on November 13.

Source: U.S. Energy Information Administration, Thomson Reuters Data as of 11/17/14.

For families who heat their homes with oil, the current savings are significant. Moreover, it appears lower oil prices can accrue to economic savings for state and local municipalities as well, except for the oil producing dependent states, such as Louisiana, where revenue from royalties and leasing, in my view, are poised to fall. Taken in total, the benefit one stakeholder enjoys seems to be neutralized by the lost revenues of the other, but fortunately I don’t believe this is likely to impede the U.S. economic recovery.

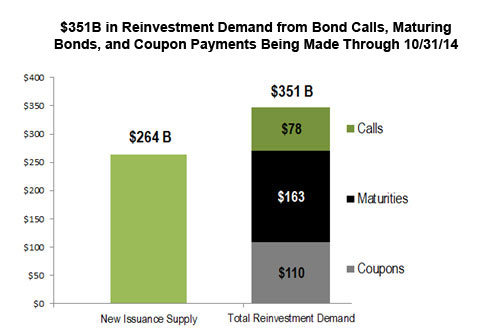

The second item is simplistic as an illustration of why municipals have continued to perform well. The imbalance of cash chasing too few bonds historically has been — and I expect will continue to be — the story. With current interest rates remaining range bound, municipals can present a compelling value proposition for investors.

Source: Siebert, Brandford, Shank & Co. LLC. as of 10/31/14.

Finally, it is with sadness and respect that I acknowledge the passing of James (Jim) A. Lebenthal, whose family, according to The Bond Buyer, is often referred to as “the first family of New York City municipal bonds.” He was a friend to our business and the municipal marketplace, as well as one of the best advocates of the public benefits hidden within the capital markets. His advocacy will long resonate as a legacy that will continue to shine light upon the good that municipals generally deliver to millions of U.S. residents.