Three things typify systemic equity crises. Firstly, volatility increases. Secondly, correlations rise. And lastly, the stock market falls.

October was a difficult month for European equities. The S&P Europe 350 fell by over 3%, taking a day-to-day lead from Greek government bond prices, and with every sector and nearly every country posting a loss for the month. A 3% loss is not unusual, nor remarkable. But the warning lights are flashing…

- 22-day realized volatility in the S&P Europe 350 has nearly tripled since September and is currently registering a level higher than at any point in the last two years:

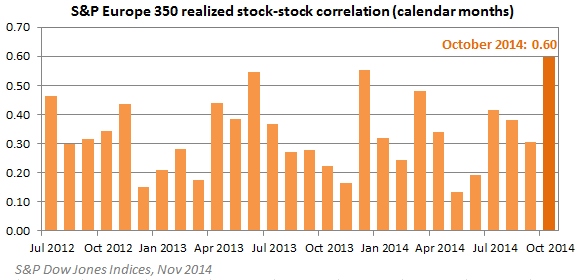

- More worryingly, the degree to which stocks move together has risen materially; the correlation among S&P Europe 350 stocks for the month of October was also the highest for over two years. (Indeed, it is close to its highest since 2007)

This may be a flash in the pan – an over-reaction, perhaps, to an underwhelming package of measures unveiled by the ECB in early October, or to economic figures in Germany and France that, while disappointing, were hardly extraordinary. And Japan’s central bank has is coming to the rescue.

However, high correlations and high volatility tend to persist in the short term. And elevated levels of both lead to a highly unstable marketplace.

Don’t be surprised if there are some bigger bumps down the road.

This article was written by Tim Edwards, director, index investment strategy, S&P Dow Jones Indices.

© S&P Dow Jones Indices LLC 2013. Indexology® is a trademark of S&P Dow Jones Indices LLC (SPDJI). S&P® is a trademark of Standard & Poor’s Financial Services LLC and Dow Jones® is a trademark of Dow Jones Trademark Holdings LLC, and those marks have been licensed to SPDJI. This material is reproduced with the prior written consent of SPDJI. For more information on SPDJI, visit http://www.spdji.com