Driven by risk-on sentiment, global equities performed relatively well despite the negative Q1 US GDP print, helping to drive ETF AUM levels to new records. Emerging market equities outperformed the developed markets. Global fixed income markets were up modestly in June, despite headwinds from rising rates. The US Treasury yield curve shifted up during the month. The upward shift in US rates, especially in the intermediate and long end of the curve, drove negative returns across a broad range of maturities. The strongest performance was in credit as investor demand for credit drove significant spread compression in domestic and international markets.

WHAT THE FLOWS TELL US

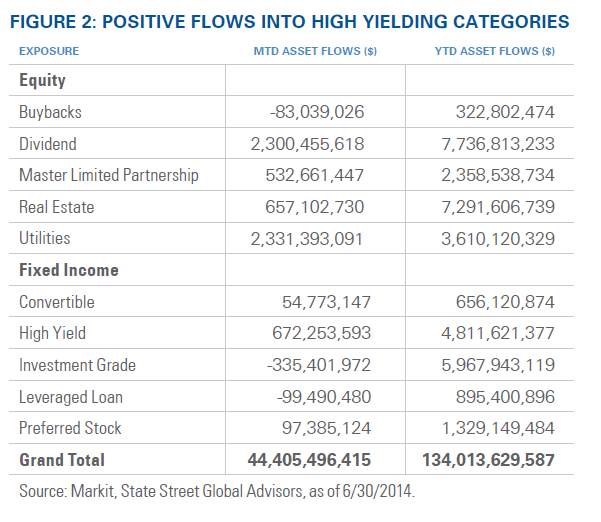

Flows into the ETF market continue to show signs of strength with $44.4b coming in June, driving YTD totals to over $134.0b. June’s $44.4b of inflows more than doubled May’s $20.7b of inflows. The over $34.8b of inflows into equities was disproportionate relative to all other categories and is a further sign of risk-on behavior. Emerging market funds continue to see inflows but remain trumped by developed markets. In June, EM equity funds saw over $4.7b with fixed income adding close to $1.2b. Across the broader fixed income landscape, investors added to both government and corporate ETFs with the blended maturities receiving the most interest.

Thematically, investors continue to exhibit a bias for funds that offer attractive yield as the need for income remains paramount. This has manifested itself across asset classes. Dividend ETFs experienced $2.3b of inflows helping to drive the category to over $7.7b of net flows on the year. Not too far behind were real estate funds with close to $7.3b of inflows. MLPs (master limited partnerships) are another area seeing continued interest for their attractive income potential with close to $2.4b of inflows through June. Fixed income has seen its share of flows tilted toward funds with positive income generating attributes as well. Investment grade funds have seen $5.9b of inflows and High Yield stands at $4.8b. Interestingly, leveraged loans have experienced a couple months of modest outflows, but still stand at a positive $895m for the year. Not to be left out are hybrids, with the convertible and preferred groups taking taken in sizable assets this year as investors are willing to look outside the box in their search for yield.

With so much money moving into high yielding assets, many investors are rightfully questioning their valuation levels. With today’s extraordinarily low interest rates likely to continue for some time, one could argue that many assets are over valued on an absolute basis. However, investing is about relative opportunities and those must be considered across and within asset classes in order to make decisions regarding capital allocation.