Detroit: The anniversary of the city of Detroit essentially declaring bankruptcy by cancelling payments on $40 million of debt obligations last summer is not dragging down the state of Michigan. As observed by the S&P Municipal Bond Michigan General Obligation Index, the state’s debt is trading on par with the rest of the U.S. municipal bond universe. Both Michigan G.O. bonds and the S&P Municipal Bond Index have annual returns between 6-7% with yields struggling to eclipse 3%. The federal ruling last week that entitles Detroit to $15 million a month in casino revenue certainly helps the city’s ability to make their debt payments.

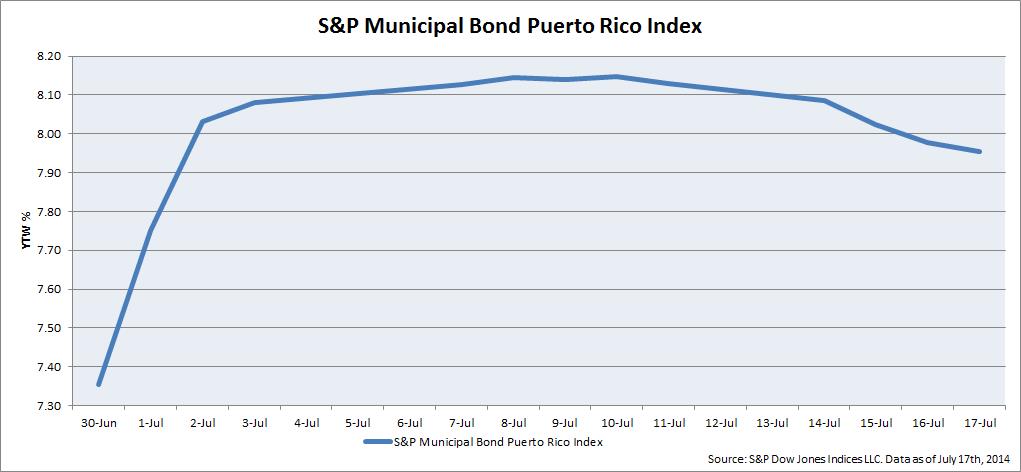

Puerto Rico: Puerto Rico had investors demanding higher yields last week after the island passed a law in late June allowing PREPA, the Puerto Rico Electric Power Authority, to restructure their debt. The edict was not received warmly by the holders of $73 billion dollars in Puerto Rico related debt, especially since the unincorporated territory doesn’t have the benefit of bankruptcy Chapter 9. Investors are demanding higher yields to hold the recent downgrade to junk status debt. This is demonstrated in the graph below with the S&P Municipal Bond Puerto Rico Index. Yields have risen from 7.35% to 7.95% or 60bps since the beginning of the month. The index has a negative 1-year return of (15.58%).

Tobacco: July hasn’t been good to tobacco bond holders either. Following the Tobacco Master Settlement Agreement of 1998, tobacco companies have to essentially pay a sin tax for the negative effect their product has on American health. Percentages of revenue from the likes of Philip Morris & R.J. Reynolds have been ruled to contribute towards smoking related medical costs and awareness campaigns. The agreement, which has a minimum cash flow floor of $206 billion over the 25-year span since the enactment, is being used as the source of funds on the municipal tobacco debt.