The PowerShares Buyback Achievers Portfolio (NYSEArca: PKW) is up more than 35% this year and closed Monday with $2.27 billion in assets under management, $1.83 billion of which flowed into the fund this year,

That makes PKW the third-best PowerShares ETF when it comes to 2013 inflows and that is saying something because the firm issues 115 ETFs. http://www.invescopowershares.com/flows/

This is not the first time PKW, which celebrates its seventh birthday this Friday, or its underlying index, have topped marquee U.S. benchmark indices.

“The NASDAQ US Buyback Achievers Index is having a very good year. It the last 12 months, the Index is up +43.35% which easily outperforms the NASDAQ US Benchmark Index, up just +31.62% over the same period. In fact, the Index has outperformed the US Benchmark Index over the last 2, 3, 5, and 10 year periods as well. The index has outperformed the US Benchmark’s size segments as well, though by varying amounts,” according to NASDAQ OMX Global Indexes.

As the table below indicates, the NASDAQ US Buyback Achievers Index has a penchant for outperforming its benchmark as well as large- and small-cap indices.

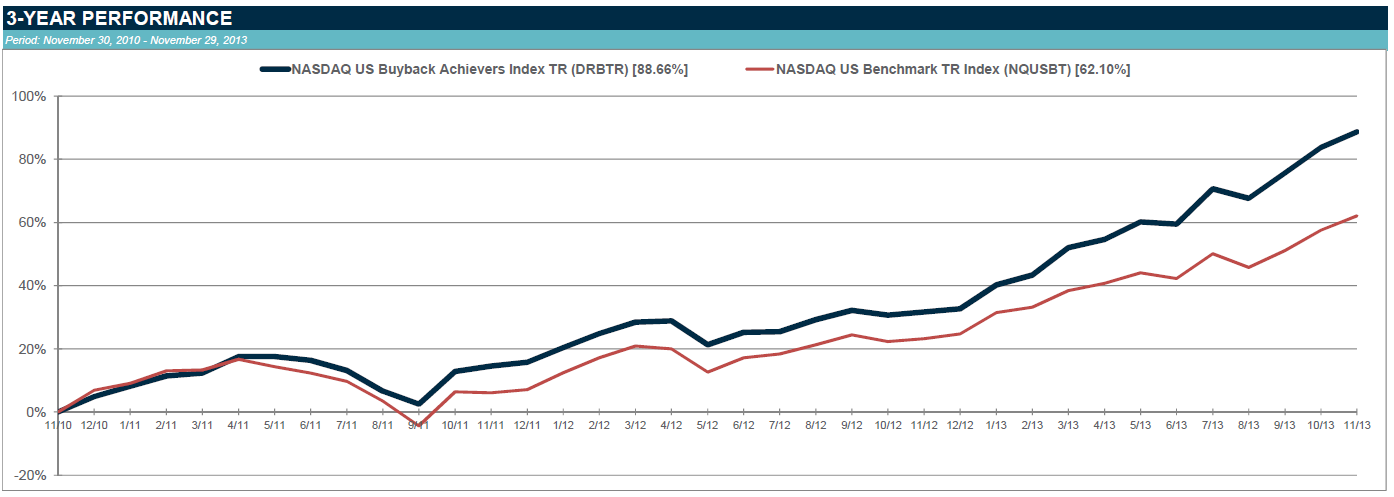

Chart Courtesy: NASDAQ OMX Global Indexes.

Here’s a look at the NASDAQ US Buyback Achiever Index on a total return basis against its NASDAQ US Benchmark. The former crushes the latter over the past three years.

Chart Courtesy: NASDAQ OMX Global Indexes