The events in the fixed income markets of the past several months may have left many municipal bond investors concerned, if not confused, about what to think and how to react.

Over the long term we could potentially be looking at higher interest rates as the new normal. With that in mind, I want to begin a discussion about ways one could seek to recalibrate a municipal bond investment strategy in the current investment reality. I believe investment-grade municipal bond investors may want to consider positioning their core muni holdings in intermediate maturities (6-17 year range) because:

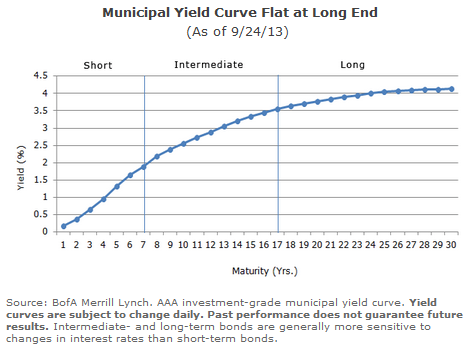

- The intermediate muni index (LMT2TR) shown in the chart below has historically outperformed the short- and long-term muni indices.

- As shown in the chart below, long-term munis, e.g., those above 17 years, offered little extra yield in exchange for their generally higher sensitivity to rising interest rates — only 0.57% of additional yield from 17 to 30 years.

To access the intermediate part of the muni market, investors may want to consider an ETF of intermediate municipal bonds such as ITM®, Market Vectors Intermediate Municipal Index ETF. ITM’s underlying index, the Barclays AMT-Free Intermediate Continuous Municipal Index (LMT2TR), focuses on bonds with 6-17 year maturities.

James Colby is a portfolio manager and senior municipal strategist at Market Vectors ETFs.