With the Fed deciding to delay tapering at their last meeting, it looks like the rise in interest rates that many investors have been fearing won’t happen quite yet. Eventually, as the Fed slows down and ultimately stops their bond-buying program and begins to increase the Federal Funds Rate, we will likely see higher interest rates. But for now, the timing of these events has been pushed out.

Despite this recent news, we still see a lot of people focused on investments with low levels of duration, a common measure of interest rate sensitivity. This has been a driving trend in fixed income ETF and mutual fund flows this year, and is likely to continue until we see higher interest rates. The idea is to invest in funds that will be less impacted by a rise in interest rates, whenever that will occur.

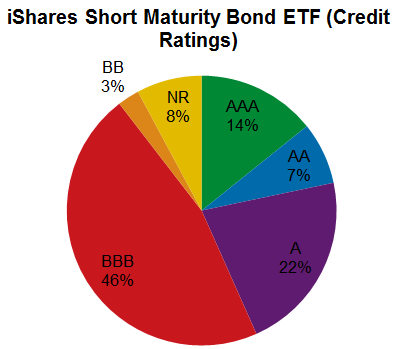

iShares recently listed a new fund that is aimed at just these investors. NEAR is the ticker of the iShares Short Maturity Bond ETF. The fund invests in a diversified portfolio of short maturity fixed income securities such as government bonds, corporate bonds, asset-backed securities, and mortgage-backed securities. It may also invest in commercial mortgage-backed securities. With a typical duration of around one year, the fund’s interest rate sensitivity should stay low. The fund will also try to produce income and will invest at least 80% of its net assets in investment grade securities. Here is a snapshot of the current holdings:

Credit ratings displayed are from S&P as of 10/2/2013.