The S&P 500 is up a very respectable 20% so far this year but U.S. small-cap ETFs are outperforming in a sign that investors are comfortable taking on more risk.

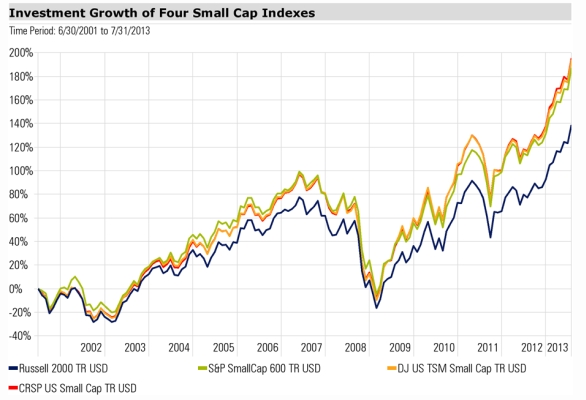

“Small-cap stocks have been on fire this year, with the Russell 2000 Index of small-cap stocks returning 24.0% through July compared with 19.6% for the S&P 500 Index,” says Morningstar ETF analyst Michael Rawson. “Small caps make up less than 15% of the U.S. equity market, but over the long term, small-cap stocks have outperformed large-cap stocks.”

There are many ETFs to choose from that track U.S. small-cap companies, but Rawson notes that more than 90% of the assets under management are concentrated in four funds: iShares Russell 2000 Index (NYSEArca: IWM), iShares Core S&P Small-Cap ETF (NYSEArca: IJR), Vanguard Small Cap ETF (NYSEArca: VB) and Schwab U.S. Small-Cap ETF (NYSEArca: SCHA). [U.S. Small-Cap ETFs Running on Fumes?]

“These funds are fairly similar, offering diversified, market-cap-weighted exposure to small-cap stocks at low expense ratios. But each follows a different index and each has features that make them appealing to different investors,” the analyst wrote in a commentary posted Friday.

Charts source: Morningstar

Full disclosure: Tom Lydon’s clients own IWM and SCHA.

The opinions and forecasts expressed herein are solely those of John Spence, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.