Bond investors keep a close eye on the “breakeven rate” between TIPS and Treasuries. This is determined by comparing the yields of regulator government bonds against inflation-protected securities of the same durations. If inflation averages more than the breakeven rate over a given time period, then investors would be better off owning TIPS than normal Treasury bonds.

The breakeven rate has been falling recently.

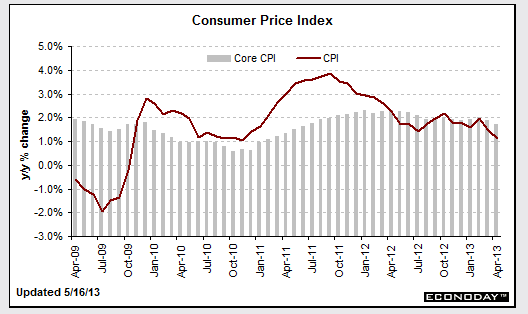

“TIPS investors have been hit by a double-whammy of headwinds in recent weeks: tame inflation in the U.S. and comments from Federal Reserve officials indicating they are making plans to cut back purchases of Treasuries and mortgage bonds,” WSJ reports.

“For TIPS to do well, you need either inflation or the Fed,” said Chris McReynolds, head of U.S. Treasury Trading at Barclays, in the article. “Right now, you have neither.”

Markets are focused on the Fed decision Wednesday followed by a press conference with Ben Bernanke.

It’s important to remember that TIPS are sensitive to interest rates so related ETFs can lose value when Treasury yields rise. Bond prices and yields move in opposite directions.

Jeffrey DeMaso, director of research at Adviser Investments, in a recent note pointed out that investors binged on TIPS because they thought the Fed stimulus would spark inflation. But that hasn’t happened.

“Paradoxically, as the U.S. recovery looks on track, investors are suddenly less concerned about inflation, and are selling TIPS,” he wrote.

“But TIPS are more attractive today than they were several months ago—inflation looks to be a greater risk today, the hurdles for inflation protection are lower, hence that protection is cheaper,” DeMaso added.

iShares TIPS Bond ETF

Full disclosure: Tom Lydon’s clients own TIP.