This report analyzes the impact of recent the technical developments in the Technology Select SPDR Fund (NYSEArca: XLK).

Two significantly bullish events recently unfolded for XLK at the end of April 2013. The first was the relative strength breakout from its September 2012 downtrend line. The other was the creation of a positive outside month pattern. In the past however, positive outside month patterns in XLK coincided with an end to relative strength leadership.

This time around things appear to be different as XLK looks to be gaining relative strength, not losing it. It’s not all good news though as a large head and shoulders top is still apparent. Continued relative strength and the outcome of this pattern will have a ripple effect through the market. [Lagging Tech Sector ETFs Need Apple Turnaround]

XLK has broken out of its relative strength (vs. the S&P 500) downtrend and confirmed a bullish positive outside month pattern in April 2013. History tells us that the previous three positive outside months that developed over the past 4-years actually marked a peak in the relative outperformance of XLK. Will this time be different? I am betting that it will.

Relative strength breakout could turn loser into leader

Relative strength charts are an important yet simple tool for technical analysts. It is just a ratio of one asset versus another in which a rising line suggests that the numerator is stronger than the denominator and vice versa. It is said that turns in relative strength tend to occur ahead of price moves, so this can be used as a way to anticipate changes in trend.

Relative to the S&P 500, XLK has broken out of its September 2012 downtrend line. From a long-only US equity portfolio standpoint*, this suggests that money is now moving back into this beaten up sector as technology could be emerging as a new leadership sector, at least relatively speaking.

Bullish accumulation has emerged

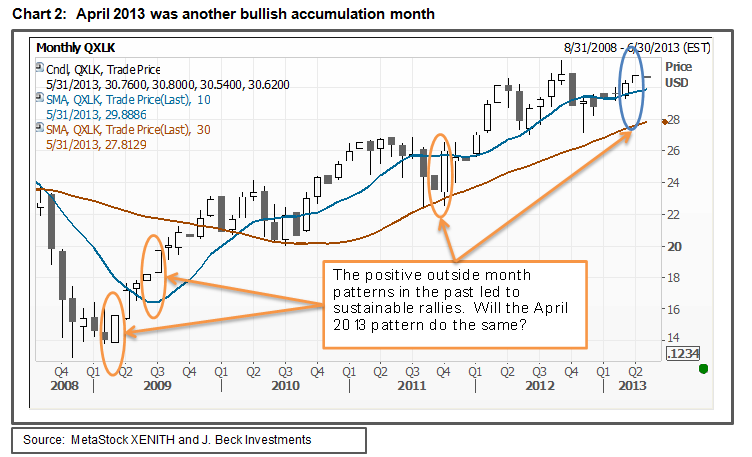

A positive outside month pattern is a technical sign of accumulation that consists of a monthly high which is higher than the previous month’s high, the monthly low is lower than the prior month’s low, and the close is above the prior month’s close. A monthly pattern is often seen as a powerful technical pattern as it takes a concerted effort of investors in order to shape it.

The three prior patterns have led to strong rallies and a continuation of its 2009 uptrend. This bodes well for absolute performance for XLK, but is there any correlation between a positive outside month pattern and its relative performance? The fact is that there does appear to be such a correlation, but it may not be what you expect.

Next page: Things are different this time