Exchange traded funds (ETFs) are struggling in early trading even after several positive economic reports were released this morning.

Continuing an ongoing trend of retailers beating analysts’ estimates, department-store operator Macy’s Inc. (NYSE: M) reported upbeat earnings. Also, the U.S. labor department announced that jobless claims fell by 24,000 to 435,000 last week. Adding to the good economic data is the news that U.S. import prices rose 0.9% in October. If you’re bearish on the market’s moves, ProShares UltraShort Dow30 ETF (NYSEArca: SDOW) is one way to play today’s slide; it’s up nearly 2% in early trading. [All About Leveraged and Inverse ETFs.]

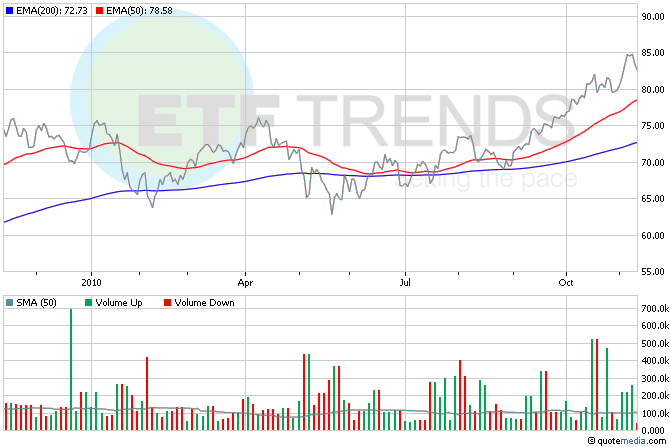

Asian markets are up after government data showed China’s trade surplus rose to $27.15 billion in October from $16.9 billion in September. Exports rose sharply, but the pace of growth slowed from the preceding month, while the pace of growth in imports accelerated. The data come as leaders of the Group of 20 nations prepare for an important meeting in South Korea. With China’s trade surplus again at historically high levels, the disparity in global trade balances is will likely be the key point debated the G20 meeting. SPDR S&P China (NYSEArca: GXC) is down more than 1% in early trade. [Choosing Among China ETFs.]

The crisis in Ireland is worsening, causing investors to dump bonds in droves and pressuring the euro lower. The markets seem to be betting that the Emerald Isle will seek another bailout from the European Union. Currency Shares Euro Trust (NYSEArca: FXE) is down 0.6% so far today. [Play the Currency Wars With ETFs.]

Read the disclaimer; Tom Lydon is a board member of Rydex|SGI.

Gregory A. Clay contributed to this article.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Mr. Lydon serves as an independent trustee of certain mutual funds and ETFs that are managed by Guggenheim Investments; however, any opinions or forecasts expressed herein are solely those of Mr. Lydon and not those of Guggenheim Funds, Guggenheim Investments, Guggenheim Specialized Products, LLC or any of their affiliates. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.