Global concerns about possible Chinese government austerity measures and debt problems in Europe are overriding positive corporate earnings reports and driving down equity exchange traded funds (ETFs) in early morning trading.

ETFs are down even though the U.S. government reported wholesale prices rose less than expected in October, up 0.4%, while core producer prices, which exclude food and energy costs, showed a decline of 0.6%. The October decline is the largest in more than four years, underscoring the U.S. Federal Reserve’s concerns about the low inflation environment. The ProShares Ultra 20+ Year Treasury ETF (NYSEArca: UBT ) is up 2% today in response to the inflation news. [Coping With a Bond ETF Bubble In Retirement.]

Asian stocks are off big-time, dragged down primarily by China’s Shanghai Composite index, which slumped 4%, as continued fears about the prospect of higher interest rates is sparking a sell off of Asian shares. Adding to the unfavorable Asian economic news, the Bank of Korea raised its base bank rate by a quarter of a percentage point, to 2.5%, in an effort to head off inflationary pressures. First Trust ISE Global Copper (NASDAQ: CU) is down nearly 5% as concerns about China’s demand for copper and other metals take hold. [4 Things Driving Copper ETFs.]

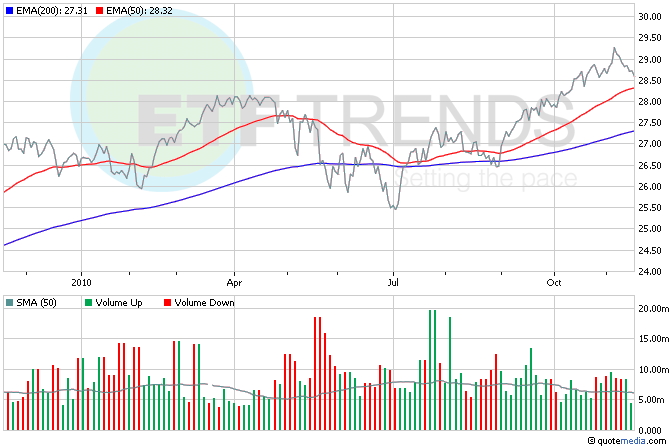

Shares in Europe are also headed south ahead of a meeting of Euro zone finance ministers, who will try to figure out how to end Ireland’s debt crisis. Dublin officials are still resisting pressure to seek a bailout. People in Ireland don’t like the proposed austerity measures that would probably be part of any bailout agreement. iShares S&P Europe 350 (NYSEArca: IEV) is down nearly 2% so far today. [Eastern Europe ETFs Outperform.]

On the U.S. corporate front, investors trained their focus on earnings reports from the retail sector. Leading discounter Wal-Mart (NYSE: WMT) reported a 9% rise in third-quarter profit and the world’s largest retailer also raised its full-year forecast and gave fourth-quarter guidance that exceeded Wall Street estimates. Wal-Mart shares are up more than 2% in early trading. Despite the reports, Consumer Staples Select Sector SPDR (NYSEArca: XLP) is down 0.5% so far this morning; Wal-Mart is 9.3%. [Consumer Staples Boosted by Emerging Markets.]

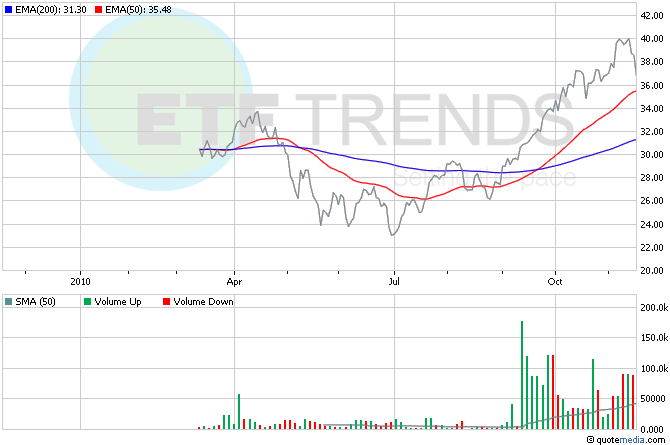

Home Depot Inc. (NYSE: HD) stock is up 3% today after the leading U.S. home-improvement retailer reported third-quarter net income climbed a stronger-than-expected 21%. Home Depot had already raised its forecast of full-year per-share profit to $1.90 figure but lowered its sales estimate to an increase of 2.6%, down from 3.5% previously. This news comes on the heels of reports that homebuilder sentiment rose just slightly for the second consecutive month to 16; a reading above 50 means more homebuilders see conditions as good instead of poor, so there’s a long way to go. iShares Dow Jones U.S. Home Construction Index (NYSEAca: ITB) is down nearly 1% today; Home Depot is 4.6%. [Homebuilder ETFs Looking for Their Break.]

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.