It’s been said that copper is a harbinger of the direction of the economy because its prices have a tendency to signal direction. What sayeth copper exchange traded funds (ETFs)?

Matt Phillips for The Wall Street Journal explains that copper prices are believed to signal turning points in the global economy. Since the metal bottomed recently on June 9, it’s up about 24%. During the same period, the S&P 500 has risen only 5.1%. [Mining ETFs Face Global Shift.]

Translation: Strategas Research feels that the numbers indicate strength despite persistent calls that a global double-dip recession could occur. Perhaps the bears are a little too bearish, in other words.

Not everyone sees it that way, though. One analyst says that given copper’s tremendous jump in recent months, it may be due for a pullback, reports Anna Stablum and Yi Tian for Bloomberg. Set up an alert to be notified if this current uptrend winds down. [Bullish Sentiment for Copper ETFs.]

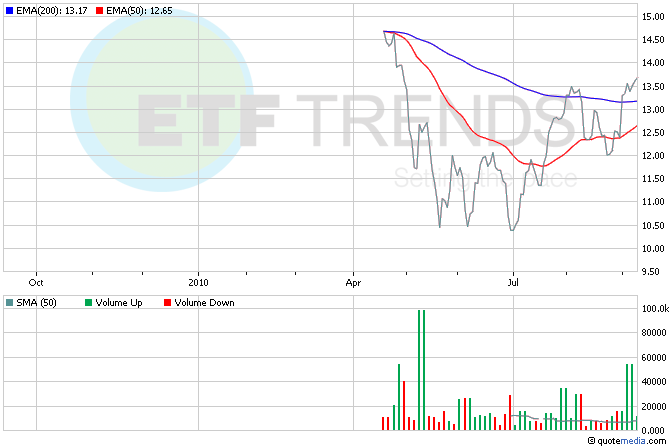

For more stories about copper, visit our copper category. The ETF Analyzer shows two copper ETFs, both of which are well above their long-term trend lines:

- First Trust ISE Global Copper (NASDAQ: CU)

- Global X Copper Miners ETF (NYSEArca: COPX)

Tisha Guerrero contributed to this article.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.