The international banking industry has a new set of rules with which to comply. Although they may take years to be fully enacted, financial exchange traded funds (ETFs) are reacting well to the news early this morning.

According to the ETF Dashboard, financial ETFs heartily approve of the new rules for banks the world over. The regulations, aimed at averting another international financial crisis, have funds such as KBW Bank (NYSEArca: KBE) up more than 3%.

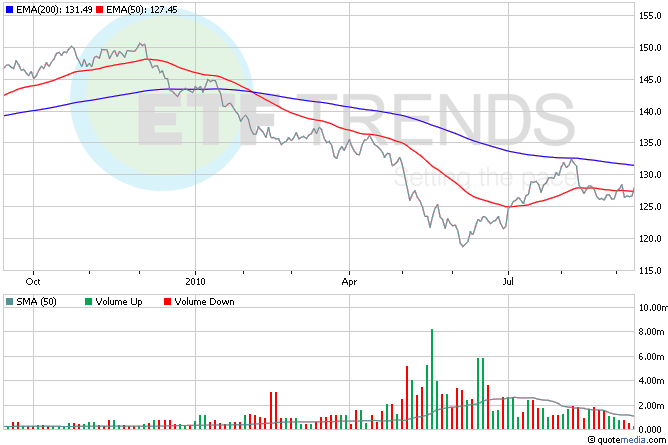

The banking industry rules will be phased in over the next eight years. The crux of the new rules is tougher capital requirements that they’ll need to guard against losses in the event of catastrophe. One asset that reacted well to the new rules was the euro, which moved higher on the news that the requirements would take years to enact. CurrencyShares Euro Trust (NYSEArca: FXE) is up 1% so far today. [Travel the World With Currency ETFs.]

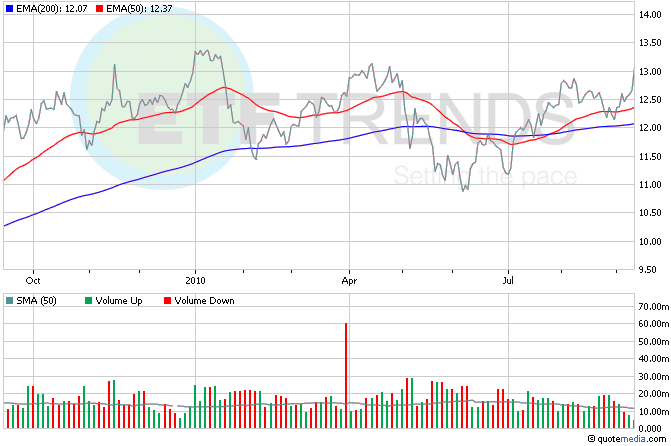

iShares MSCI Taiwan (NYSEArca: EWT) is another leader this morning, reacting to strong economic data from China. Industrial production rose 13.9% from a year ago in China, besting even the 13.4% growth rate seen in July. [Trade Agreement Agrees with Taiwan ETFs.]

Read the disclaimer; Tom Lydon is a board member of Rydex|SGI.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Mr. Lydon serves as an independent trustee of certain mutual funds and ETFs that are managed by Guggenheim Investments; however, any opinions or forecasts expressed herein are solely those of Mr. Lydon and not those of Guggenheim Funds, Guggenheim Investments, Guggenheim Specialized Products, LLC or any of their affiliates. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.