The Federal Reserve is wrapping up its two-day meeting this week. Ahead of the announcement during which the policymakers are expected to discuss ways to jump-start the economy, exchange traded funds (ETFs) are trading lower.

According to the ETF Dashboard, metals ETFs – yesterday’s leaders – are trading down by as much as 3% in early trading:

Some anticipate that the Federal Reserve may announce liquidity measures in the form of bond purchases. Others believe that it might be too early for any big moves. But the pressure is on for the Central Bank to do something following Friday’s flat jobs report.

Stocks were also hit his morning by weak trade data from China and the first drop in U.S. productivity in 18 months, by 0.9% in the April through June period. Imports into China dropped sharply and widened the country’s trade surplus to $28.7 billion in July from $20.02 billion in June. The slower growth of imports illustrate that any stimulus impact in China is starting to wane. Any slowing in China could have a ripple effect, particularly in the raw materials space. [10 New ETFs Worth a Look.]

- First Trust ISE Global Copper (NASDAQ: CU)

- Market Vectors Steel (NYSEArca: SLX)

- SPDR S&P Metals & Mining (NYSEArca: XME)

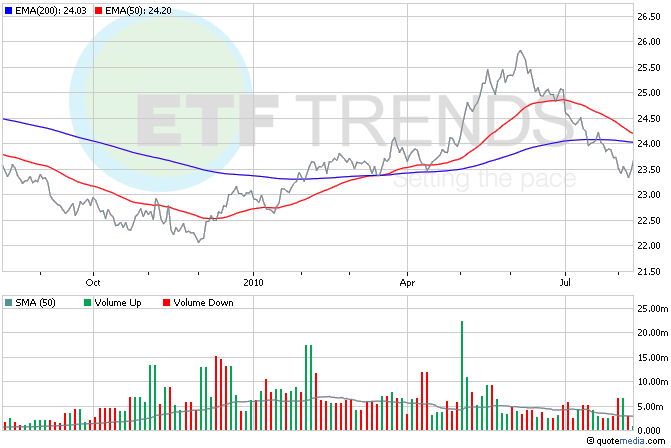

On signs of weaker consumption in China and a flight to safety ahead of the Fed’s announcement, the U.S. dollar ETF is turning higher. The Australian, Canadian and New Zealand dollars are all down, while the British pound also took a beating on weaker housing data. PowerShares DB U.S. Dollar Bullish (NYSEArca: UUP) is up nearly 1% in early trading. [Trends Spotted in Dollar, Yen and Euro ETFs.]

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.