South Korea’s economy grew in the second quarter. That growth has yet to translate over to South Korea exchange traded funds (ETFs), which are down for the last month.

That may not be the case for long, though. There are some encouraging signs being seen in the South Korean economy:

- GDP grew 1.5% in the second quarter, beating the general consensus of 1.3% growth.

- In addition to that, GDP also rose 7.2% from a year earlier, reports Michael J. Munoz for The San Francisco Chronicle. [How Rising Tensions In South Korea affect ETFs.]

- Also Asian currency gains are an indicator of the optimism surrounding the region. Yumi Teso and Frances Yoon for Bloomberg report that South Korea’s won is among the Asian currency leaders, thanks to optimism about interest-rate increases and the fact that regional growth is attracting assets. South Korea’s central bank has raised benchmark rates this year, widening their currencies’ yield advantage over the Group of Seven nations.

- David Shepardson for the Detroit News reports that the Korean ambassador to the United States urged Michigan business leaders to back approval of a long-stalled free trade agreement between the two countries, saying U.S. auto imports “can and should be increased a lot more.” Naturally, it would benefit both economies. [How Worries In South Korea Affect The Dow.]

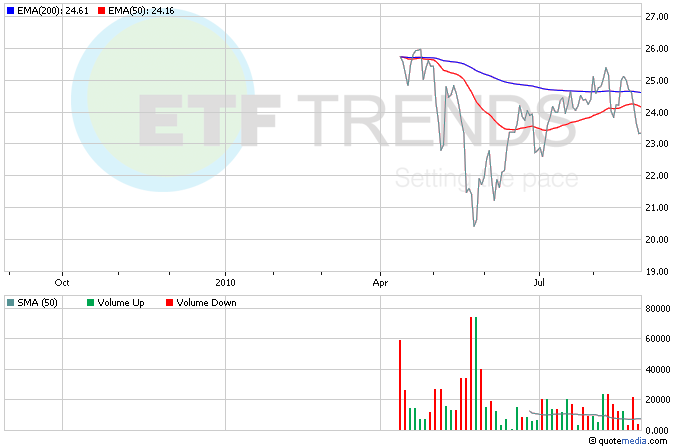

The two ETFs listed below are the most direct ways to play the South Korean economy. There’s no direct play on the South Korean won (though there is one in registration from WisdomTree), you can get partial exposure via the WisdomTree Dreyfus Emerging Currency (NYSEArca: CEW). The fund holds a basket of eight to 12 currencies, which are selected annually. Each currency is weighted equally and reset quarterly to maintain those weights. You can read more about the fund’s inner workings here.

- iShares MSCI South Korea Index (NYSEArca: EWY)

- IQ South Korea Small Cap ETF (NYSEArca: SKOR)

Tisha Guerrero contributed to this article.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.