Economic uncertainty, lingering debt problems in Europe, tepid employment numbers and high volatility are just some of the reasons why the markets and exchange traded funds (ETFs) have see-sawed in the part quarter. Still, investors found some safe havens and heavily traded in two particular asset classes.

Gold. The current economic uncertainty will continue to make gold a hot investment, according to some. Concerns over the eurozone sovereign debt crisis, fears of a double-dip recession, possible inflation worries and a need for a general safe haven for assets are just some of the reasons why investors are parking their wealth into gold. Additionally, Central Banks have been showing signs lately that they might be shifting out of currency holdings and into gold. [Gold ETF Surges to a New Milestone.]

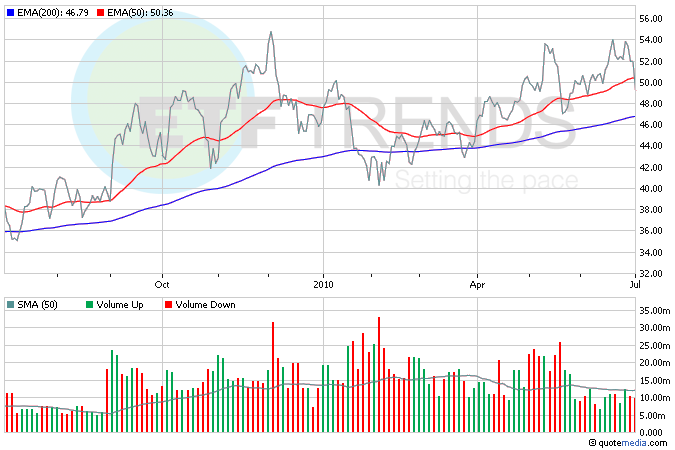

- SPDR Gold Shares (NYSEArca: GLD): recently surpassed $50 billion in assets; up 11.7% in Q2

- ETFS Physical Swiss Gold Shares (NYSEArca: SGOL): up 11.6% in Q2

- PowerShares DB Gold Fund ETF (NYSEArca: DGL): up 11.6% in Q2

- Market Vectors Gold Miners (NYSEArca: GDX): up 17% in Q2

Treasury Bonds. The eurozone crisis has pushed Treasury prices higher as investors bet that inflation will remain low for some time. Yet again, investors are seeking low-risk U.S. government debt as the euro dropped and stocks slid on ongoing concerns that struggling eurozone nations will be unable to lock in the spending cuts and tax increases that are needed to reduce their deficits. [European Debt Woes Create ETF Winners and Losers.]

Investors are looking for quality and safety right now, and it can be found in U.S. debt. A projected $380 billion will pour into bond funds this year, more than went into domestic stock funds in the past decade. [Volatile Markets Renew Bond ETF Bubble Concerns.]

- Vanguard Extended Duration ETF (NYSEArca: EDV): up 24.5% in Q2

- PIMCO 25+ Year Zero Coupon U.S. Treasury Index (NYSEArca: ZROZ): up 26.6% in the second quarter

Max Chen contributed to this article.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.