Intel’s (NASDAQ: INTC) earnings were a nice surprise for even the most bullish of analysts. Following the news, technology exchange traded funds (ETFs) soared, while the broader markets went more even-tempered.

In its report, Intel said that its previous quarters had been driven by consumer spending, but in the most recent quarter, company server upgrades drove much of the growth. Sales of laptops and PCs stayed robust, as well. Second-quarter revenue for the semiconductor behemoth was up 5%. [Apple: King of the Nasdaq-100.]

- iShares Goldman Sachs Semiconductor Index (NYSEArca: IGW): up 0.6% so far today; Intel is 8.5%

Retail sales disappointed in June for the second consecutive month. Spending fell 0.5% on the heels of a 1.1% dip in May. Excluding auto sales, which were the true weak spot, spending dropped 0.1%. In the last month, retail ETFs seem to be reflecting the mixed attitude toward spending that consumers have these days. Consumer staples have been the strongest in that time period, gaining about 1.5%. Luxury spending has also been solid. But it looks like if you’re not uber rich or just scaling back to the essentials, you aren’t spending much these days. [6 ETFs for Rising Imports.]

- Vanguard Consumer Staples (NYSEArca: VDC): up 1.8% in the last month

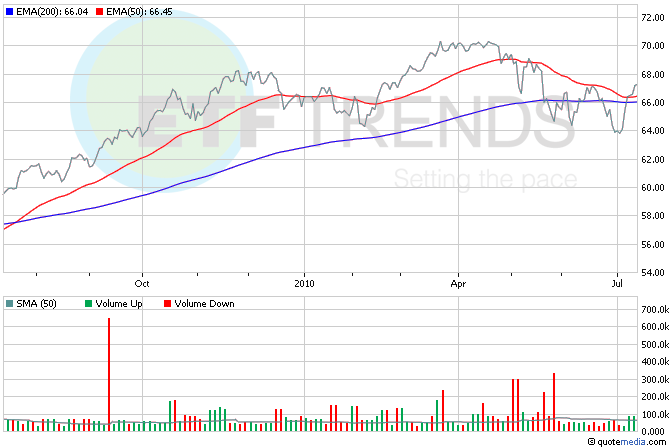

Weaker retail sales renewed concerns that the economic recovery would be glacial, sending investors for cover in Treasury ETFs. Our ETF Analyzer this morning shows that the top-performing ETF so far today is the Vanguard Extended Duration Treasury (NYSEArca: EDV), which is up 0.6%. [Leveraged ETFs Take Spotlight in Turmoil.]

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.