A monthly survey of consumers shows that confidence in the economic recovery has declined. Although the markets are slightly lower on the reports, many exchange traded funds (ETFs) are ekeing out some gains early in the day.

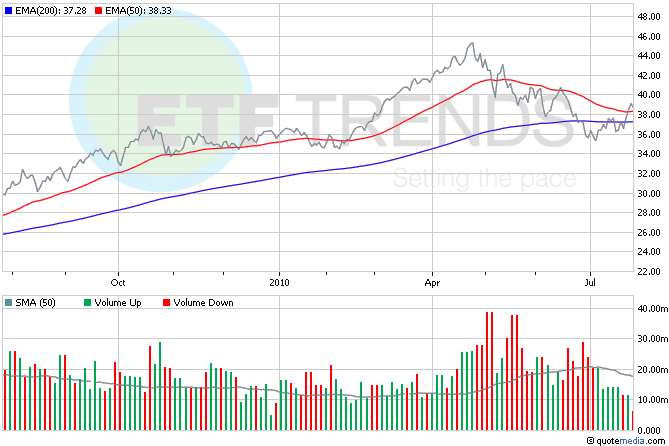

Our Dashboard feature shows some strongly positive ETFs in the markets today, led by the PowerShares S&P SmallCap Utilities Portfolio (NYSEArca: XLUS):

Consumer confidence this month fell to 50.4 on concerns about the job market, the general economy and the normally spending-heavy back-to-school season. The ETF Analyzer shows that many retail ETFs are down more than 1% this morning. SPDR S&P Retail (NYSEArca: XRT) is down 1.3%, though it’s had a good run in the last six months, gaining 10.6%. [Pockets of Strength in Retail ETFs.]

Home prices gained for the second consecutive month in May, rising 1.3% from the previous month. Most major metro areas in the Standard & Poor’s/Case-Shiller 20-city home price index gained in price, with the exception of Las Vegas, which hit a new record low. Don’t get excited, though: most analysts don’t expect the gains in price to continue through the year. [Homebuilder ETFs: Behind the Numbers.]

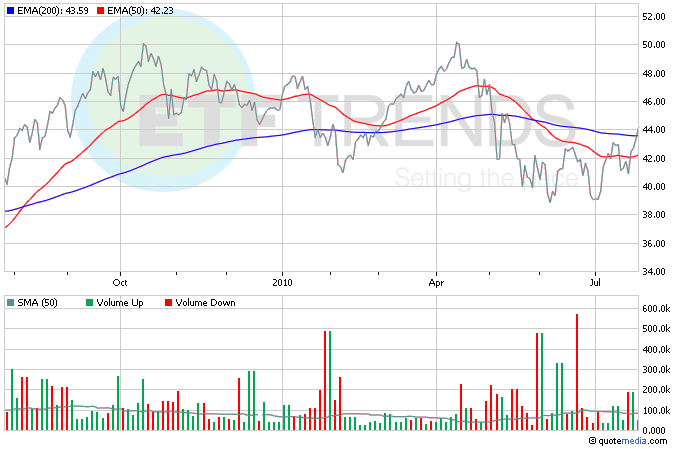

More positive bank earnings trickled in, this time from the international side of the sector: UBS (NYSE: UBS) and Deutsche Bank (NYSE: DB) both reported strong second-quarter earnings. UBS notched a profit of $2 billion and DB reported $1.5 billion in profits. iShares S&P Global Financial (NYSEArca: IXG) is up nearly 2% early; UBS and DB are both components. [Regional Bank ETFs Back in Gear.]

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.