Investors who want to use exchange traded funds (ETFs) to gain access to emerging market bonds have limited choices open to them. This may be a signal for providers to supply a product to the marketplace.

Record levels are seen for the issuance of emerging market bonds – so far this year, $306.8b has been raised. This is the best start since comparable records started in the 1970s. Chris Flood for The Financial Times explains that there are more than 250 stock market-based emerging market ETFs to choose from, while the choice of emerging market bond ETFs globally is fewer than 20. [Fixed-Income: Still a Sound Strategy?]

The major roadblock that is keeping this region of the bond market off the map could be the lack of a suitable benchmark index to track. Meanwhile, banks remain timid to lend to companies, so they have turned to bond markets to raise capital. The $231.7 billion raised by the corporate sector this year accounts for 75.5 % of all emerging market bonds sold. [Grail Will Soon Provide an Emerging Market Bond ETF.]

For more stories about bonds, visit our bond category.

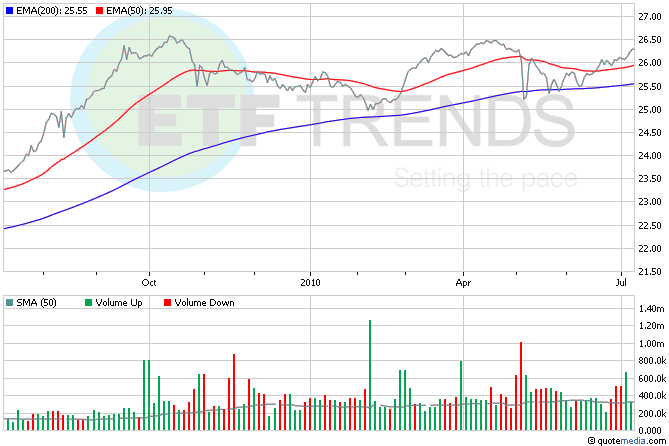

- iShares JPMorgan Emerging Markets Bond (NYSEArca: EMB)

- PowerShares Emerging Market Sovereign Debt (NYSEArca: PCY)

Tisha Guerrero contributed to this article.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.