Stocks and exchange traded funds (ETFs) gained early before paring them on conflicting news. Homebuilder sentiment is still low on the one hand, but on the other, another mostly positive week for earnings could right the listing ship.

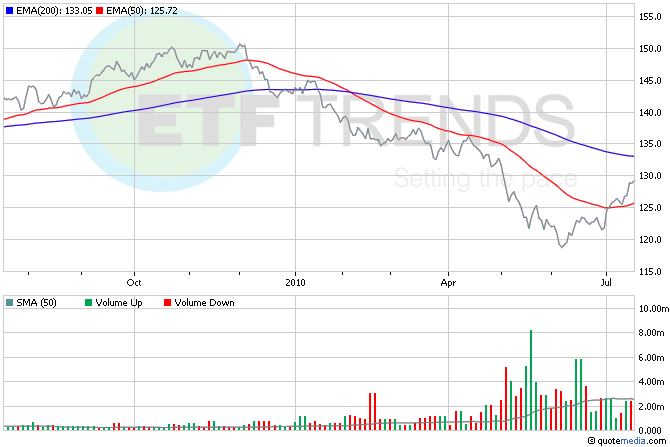

More trouble for the U.S. housing market: homebuilder confidence is at its lowest level in more than a year. Here’s some perspective: the National Association of Home Builders said its housing market index fell to 14 last month; anything below 50 indicates negative sentiment. The last time the index was above 50 was in April 2006. Homebuilder ETFs are down more than 1.5% in early trading today; for the year, they’re down about 7% on average.

- SPDR S&P Homebuilders (NYSEArca: XHB)

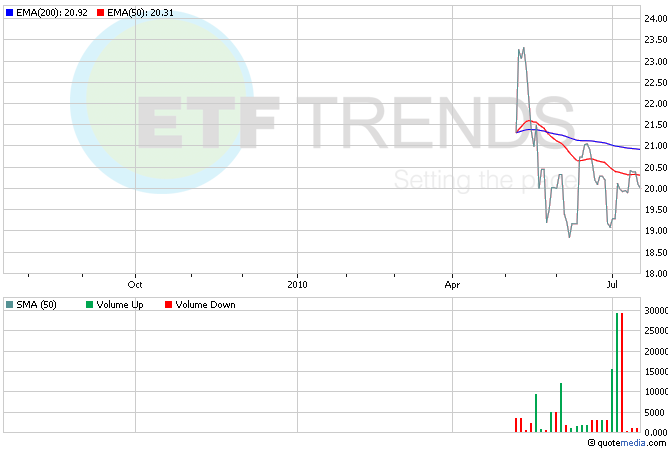

Euro ETFs are getting a little stronger this morning as investors begin to feel more optimistic about the results of the European banking system’s stress tests. The euro’s gain comes even though Moody’s downgraded Ireland’s debt this morning. The stress test results are due on Friday.

- CurrencyShares Euro Trust (NYSEArca: FXE)

- iShares MSCI Ireland (NYSEArca: EIRL) is down 0.5% so far on news of the downgrade

Read the disclaimer; Tom Lydon is a board member of Rydex|SGI.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Mr. Lydon serves as an independent trustee of certain mutual funds and ETFs that are managed by Guggenheim Investments; however, any opinions or forecasts expressed herein are solely those of Mr. Lydon and not those of Guggenheim Funds, Guggenheim Investments, Guggenheim Specialized Products, LLC or any of their affiliates. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.