One sector that may not be getting much attention these days is the utility sector. But in times of economic turmoil, the utility sector typically does better than most. But is that playing out in the sector’s exchange traded funds (ETFs)?

According to Kevin Grewal of the Street, “the utility sector is known for shooting off decent dividends and carrying a relatively high degree of safety,” since utilities are a necessary part of our lives. [The Appeal of Utility ETFs.]

Another reason utilities shine bright is that they have largely overcome many of the regulations that kept operational costs high. Additionally, utilities tend to provide a yield that is greater than their debt in low-growth environments. Currently, utilities are offering yields that are north of 5%.

Lastly, Grewal doesn’t see too much light at the end of the tunnel. Rather, he sees the expiration of the homebuyer tax credit, stubbornly high unemployment levels, trepidation in consumer confidence, and potential for deflation as the Fed keeps interest rates at all-time lows. [5 ETFs to Watch Amid Rising Industrial Output.]

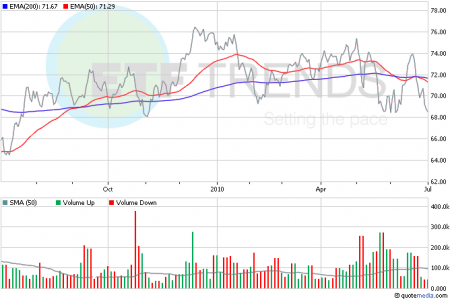

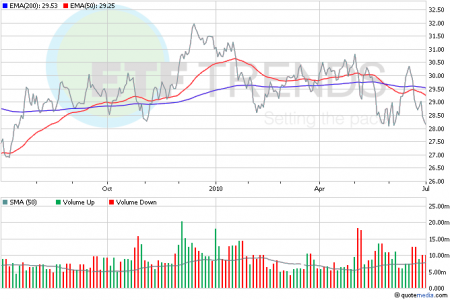

Further, while several utility ETFs are offering attractive yields, their performance has suffered along with the broader market’s, although to a slightly lesser degree. Grewal notes that ETF investors should use exit strategies to limit downside risk. These funds are all below their 200-day moving averages right now, so use caution. We employ the 200-day moving average to give us buy and sell signals. To find out more, read this article.

- Vanguard Utilities ETF (NYSEArca: VPU): has a yield of 3.96%

- iShares Dow Jones US Utilities Sector Index Fund (NYAR: IDU): has a yield of 3.99%

- Utilities Select Sector SPDR (NYAR: XLU): which has a yield of 4.38%

For more stories about utilities, visit our utilities category.

Sumin Kim contributed to this article.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.