While most developed economies stagnate, Australia’s exchange traded funds (ETFs) are riding high on a wave of solid growth, increased foreign investment and the bullish sentiments of respected asset managers.

- David Fisher, head of global product management at PIMCO, explained that Australia had low debt entering the global financial crisis and strong policy flexibility, which made the mining-driven country look attractive, reports Michael Bennet for The Australian. [Australia’s Optimism: 6 ETFs to Watch.]

- The International Monetary Fund recently upgraded Australia’s growth estimates to 3% this year and 3.5% in 2011. Treasurer Wayne Swan projected that that economy would expand 3.25% in 2010-11 and 4% in 2011-12. A recent Reuters poll showed that analysts believe Australia’s GDP will expand by 3.3% on average this year and 3.5% in 2011, according to ForexYard.

- Strong demand for Australian resources, mostly iron ore and coal, from China and India will keep Australia’s economy alive. The emerging markets will likely help insulate Australia from troubles that the developed world have to deal with, says Scott Haslem, chief economist at UBS. Haslem predicts Australia see growth of 3.5% in 2010 and 4.0% in 2011.

- Currently, the unemployment rate stands at 5.1%, and it is projected to further decrease. Inflation, which is at around the top of the Reserve Bank of Australia’s 2% to 3% target, will be the biggest domestic risk to growth.

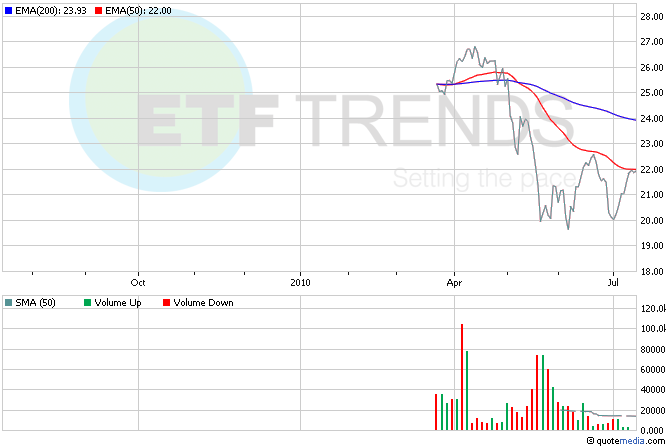

For more information on Australia, visit our Australia category. Our ETF Analyzer reveals that the two Australia-focused ETFs are up about 4% for the last five days:

- iShares MSCI Australia (NYSEArca: EWA)

- IQ Australia Small Cap (NYSEArca: KROO)

Max Chen contributed to this article.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.