Wall Street is quaking in its (fine Italian leather) shoes this morning as the U.S. House and Senate wrap up their wrangling over the financial overhaul legislation. Financial exchange traded funds (ETFs) are among those leading the way lower. The legislation in the works is expected to increase oversight of the financial industry more than anyone expected. Not long ago, investors suspected that the bill would eventually emerge as a shell of the tight restrictions proposed earlier, but that’s turning out to not be the case. This bill will the the biggest retooling of rules on Wall Street since the 1930s, and it’s all aimed at one thing: preventing another financial collapse that led to the Great Recession. [Financial ETFs Await Washington’s Reforms.]

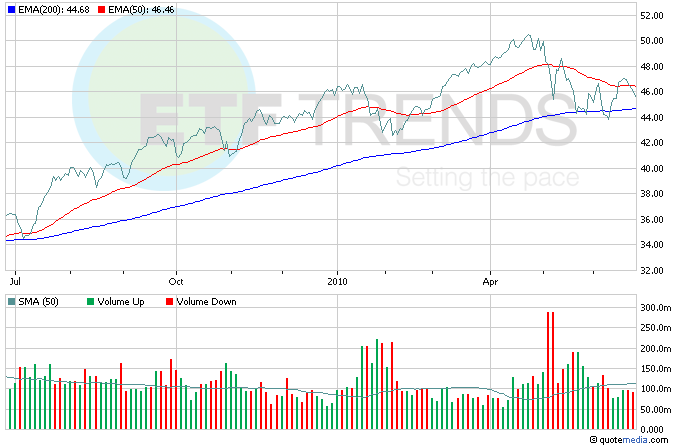

- Financial Select Sector SPDR (NYSEArca: XLF) is down nearly 2% so far today

It’s the hot new thing: Apple’s (NASDAQ: AAPL) latest version of its uber-popular iPhone has landed and thousands are lining up to get their hands on it. Pre-orders had sold out and new orders aren’t promised for delivery until July 14. If you couldn’t get in on the pre-order, then you might be among those lining up this morning to get one on a first-come, first-served basis. Apple shares are down about 0.5% so far today, however. [Can the New iPhone Save Technology ETFs?]

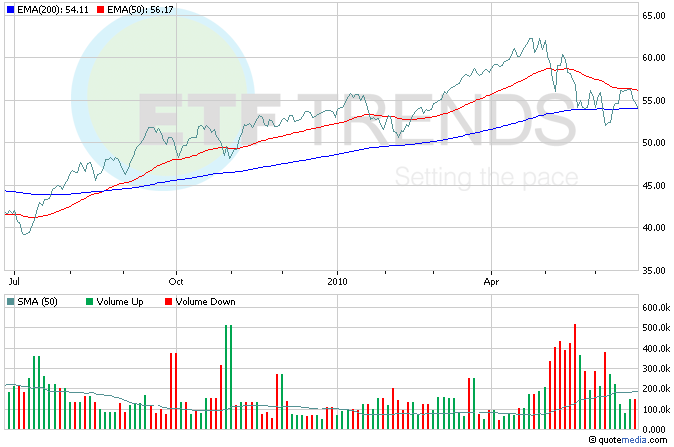

- PowerShares QQQ Trust (NYSEArca: QQQQ) is down about 1.2% so far today

Orders for durable goods – items expected to last three years or longer – rose 0.9% in May on improvements in global business investment and demand. It was the third gain in four months. The rebound in manufacturing is being led by global companies like Caterpillar (NYSE: CAT). As a result, economists have raised their forecasts for growth this quarter, undeterred by glum employment figures.

- iShares Dow Jones U.S. Industrial Sector (NYSEArca: IYJ): Caterpillar is 2.5%

For more stories on industrial growth, visit our category.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.