Exchange traded funds (ETFs) have come a long way. What was once thought to be unthinkable – that ETFs could usurp the mutual funds’ throne – now seems to be a credible threat, at least in the long run.

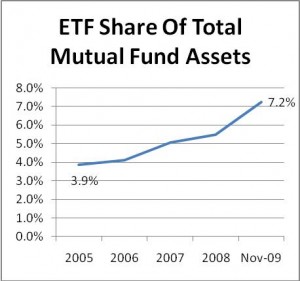

The ETF industry’s share of total mutual fund assets have jumped from 3.9% in 2005 to 7.2% as of November 2009. In dollar terms, ETFs are inching closer to the $1 trillion mark, writes Kurt Brouwar for MarketWatch. [Why ETFs are taking a greater market share.]

(Source: Index Universe)

(Source: Index Universe)

ETFs have been touted as an easy way to diversify one’s portfolio to fit any number of investment objectives at a very low fee. [What are ETFs and how do you invest in them?]

The financial industry is also benefiting from the innovative minds managing ETFs, which has also made the fund industry more competitive and efficient. One of the fronts on which they’re ramping up the level of competition is with actively managed funds – they’re similar to active mutual funds, except they also tout transparency, competitive pricing and intraday liquidity, to boot. [ETFs vs. mutual funds.]

Brouwar comments on this being a “Golden Era” of investing. The era began with the first no-load mutual funds and it has now apparently evolved into something newer and better. Everybody wins.

For more information on ETFs, visit our ETF 101 category.

Max Chen contributed to this article.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.