Commodities could be riding another bull, as the latest trend in upward momentum is working in favor of this sector, and markets and exchange traded funds (ETFs) could benefit if it happens.

Jeff Clark for The Growth Stock Wire reports that there is not a more bullish sign than when the 20-day moving average crosses over the 50-day moving average. Last week marked that bullish crossover, which Clark believes should lead to higher commodity prices over the next few months. But there are no guarantees with the stock market and the CRB Index may not be ready to recoup yet.

Crude oil, heating oil and natural gas combine to make up about 18% of the CRB Index. Gold, silver and platinum make up another 18%. Remember that commodities are a direct beneficiary of inflation, and as the world’s most important money issuers destroy their currencies, commodities could explode, reports Tom Dyson for Commodities Trading.

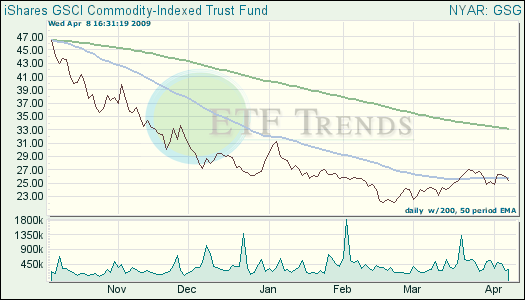

Whether we see a repeat of last year’s commodities bull, mind the trend lines when looking for signals on whether to be in or out. We use the 200-day moving average to determine when we’re in a position.

- iShares S&P GSCI Commodity Index (GSG): down 11.1% year-to-date

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.