Have the inflated oil prices of last summer become a distant memory, or will prices creep up again this season and return to haunt consumers and lead related exchange traded funds (ETFs) on a new uptrend?

Many assumed that during this global recession, one saving grace was that the price of oil per barrel had found a floor, around $40 per barrel, and that this would last until the recession rode itself out.

Jad Mouawad for The New York Times reports that a growing chorus of analysts and economists is questioning that notion. This is a minority point of view, and they see troubling conditions in the oil market that could still push prices down sharply, including a global economy that is getting worse, not better. Many are calling for oil to go as low as $20 per barrel and stay there for some time.

Another big drop could lead to a sustained period of low investments, and many executives say that would set the stage for prices to soar once the global economy finally starts to recover. The answer: reasonable prices. If more wells shut down, this will set the stage for oil prices to explode once the global economy recovers.

Thus far, OPEC is supporting the price of oil and propping up the markets by production cuts. The debate is not just a proxy for varying predictions about the economy.

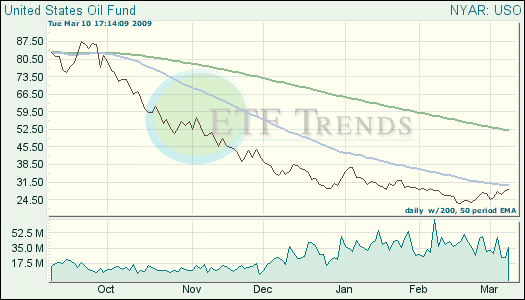

This is all just speculation, of course. Watch the trend lines to spot uptrends in oil before thinking about taking a position. Right now, these funds are below both the long- and short-term trend lines.

- United States Oil (USO): down 13.4% year-to-date; up 17% for one week

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.