Certain U.S. bank bosses faced a congressional hearing, where they were on trial for accountability and transparency regarding the direction of where public fund injections have been spent; the conclusion may not be enough to restore markets and exchange traded funds (ETFs) for the time being.

Under the Microscope. Chief executives from Citigroup (C) and Bank of America (BAC) are under scrutiny, as they have reported they spent the injection money to increase lending and to stem the foreclosure waves. Thus far, eight banks have received $166 billion in taxpayers’ money.

News Nabou on BBC reports that the eight executives under fire are Vikram Pandit of Citigroup, Jamie Dimon of JP Morgan Chase, Kenneth Lewis of Bank of America, Lloyd Blankfein of Goldman Sachs, John Mack of Morgan Stanley, Robert Kelly of Bank of New York Mellon Corp, Ronald Logue of State Street and John Stumpf of Wells Fargo.

Vikram Pandit of Citigroup opened his statement by highlighting the number of homeowners he has helped to stay in their homes; 440,000 avoided foreclosure, and $3.4 billion in annual dividends will go toward the U.S. government in an attempt to make this a profitable investment, for the government and the people.

The committee is also seeking detailed information on any 2008 bonuses paid out at the eight banks.

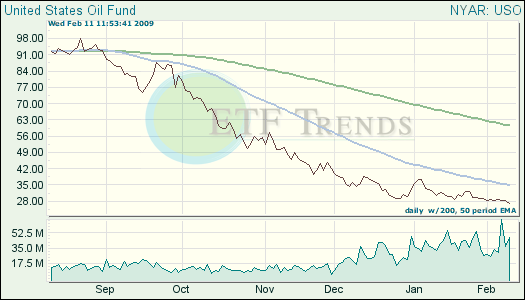

Oil Stumbles Further. Oil prices have fallen due to the high levels of crude stockpiles which are continuing to grow. The EIA’s report of a 4.7 million barrel jump in inventories for the week ended Feb. 6 surpassed the expectations of analysts, reports Dirk Lammers for Associated Press.

Prices dipped below $37 after the inventory report, as 30 million barrels have built up over the past five weeks.

- United States Oil (USO) down 6.8% for the week; down 16.9% for the month

Narrowing Deficit. The U.S. trade deficit has declined by 4% since December, down for the third month in a row, because of an overall absence in global trade. The Commerce Department reported that the gap between imports and exports shrank to $39.9 billion from a revised $41.6 billion in November, its lowest levels since 2003, reports Jack Healy for The New York Times.

Both sides will continue to show losses, and the trade deficit should continue to close the gap between exports and imports. The trade deficit for all of 2008 declined for the second year in a row, to $677.1 billion.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.