Assets in the world’s largest gold-backed exchange traded fund (ETF) have hit $30 billion, a direct reflection of the troubling economic times the world is experiencing.

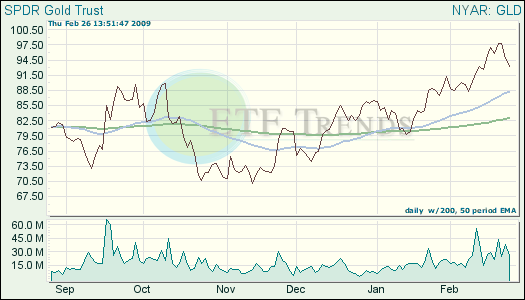

The State Street fund is the SPDR Gold Shares (GLD) whose assets have grown 60% in the past six months. ETF Express reports that the growth underscores gold’s safe-haven appeal and its recognition as an excellent portfolio diversifier among a wide array of financial advisors and investors.

GLD was launched in November of 2004, and was the first U.S. commodity-based exchanged-traded security and quickly emerged as one of the fastest growing exchange-traded products. World Gold Trust Services collaborated with State Street and is a subsidiary of the World Gold Council.

There have been questions raised about how this ETF works, and State Street has a frequently asked questions list to address some of the concerns about this fund. Some notable points include:

- The trustee, the Bank of New York, doesn’t deal directly with the public, so investors who wish to exchange shares for physical gold would have to make arrangements with his or her broker.

- The gold is held in the form of 400 oz. London Good Delivery Bars in the London vaults of HSBC Bank USA.

- The methods for safekeeping have been in place for centuries.

- The trustees are allowed to visit and inspect the holdings twice a year.

- From a tax standpoint, gold is treated as a collectible for long-term capital gains tax purposes.

- SPDR Gold Shares (GLD) up 5.3% over three months; down 2.8% over one week

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.