Yesterday, we covered the issue of whether oil exchange traded fund (ETF) investors knew what they were doing when it came to these funds. (You do). But how does the issue of contago impact oil-related ETFs?

Market Folly has an explanation on Seeking Alpha that investors might find interesting.

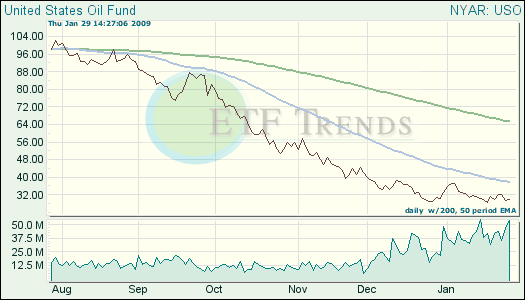

The United States Oil Fund (USO) holds long positions on oil futures, rolling them forward each month. Three factors impact the ETF:

- Changes in the spot price

- Interest income on uninvested cash

- The roll yield

Right now, the price of oil in February 2009 is less than the price of oil in April 2009 – a classic case of contango. If the opposite were true, it would be backwardation. USO, and most commodity funds, buy the “near month” contract. Since they don’t want to take delivery, the current month’s contract is sold before expiration and the next month’s contract is bought – called “rolling forward.”

USO’s prospectus warns of such a situation: a negative “roll yield” could cause the net asset value of USO to deviate significantly from crude’s spot price.

This is an important reason to read the prospectus of the fund you’re eyeing, and understand how different climates will impact the fund.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.