Mutual funds have been increasingly getting on board with exchange traded funds (ETFs) and the Aston/New Century Absolute Return Fund (ANENX) is no exception.

The fund chooses ETFs based on a proprietary screening method, using patterns of price behavior and trading volume across a mix of asset classes and sectors. The method of screening automatically sorts out similar ETFs, and only focuses on those that trade in the top half of the entire stock universe, to ensure a diversified mix.

Jim Porter, president and founder at New Century Capital Management and the creator of the screening method, began his career in the securities and futures industries in 1969 and founded New Century in 1993. The company was created to research and develop trading and portfolio management systems, as well as to develop and manage alternative investment portfolios and portfolio systems.

At any time, the fund holds from about 25 to 50 holdings, although it currently has 42 components. No component has more than a 5% weighting. When a buy signal is received, the fund enters incrementally, and exits the same way when a sell signal is hit.

The portfolio is essentially a “popularity contest,” says David Robinow, a partner at Aston Asset Management. At first, the portfolio started in stocks, but it migrated over into ETFs – a testament to how popular these funds have become in recent years. When a new fund is qualified for entry, everything in the fund is requalified for the following day.

As of Dec. 31, the top holding in the fund was the Pharmaceutical HOLDRs (PPH), which was 3.5%. Health Care Select Sector SPDRs (XLV) was 3.3%, and the iShares Russell 3000 (IWV) was 3.2%.

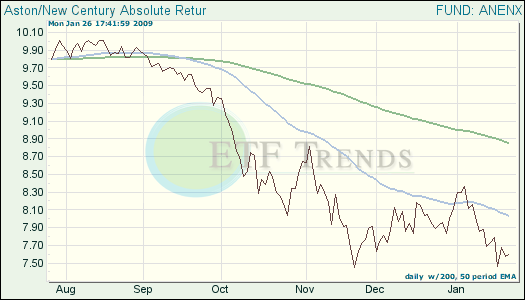

This fund, which is actively managed, comes with an expense ratio of 1.5%. Year-to-date, it’s down 6.4%, and since inception it’s down 6.3%.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.