Do microcap exchange traded funds (ETFs) indicate whether or not we have hit the halfway point of this devastating recession?

History has shown that in a bull market recovery, small companies outperform larger companies, so in essence, if smaller companies are starting to outperform larger companies then things are turning for the better, states Gary Gordon of ETF Expert.

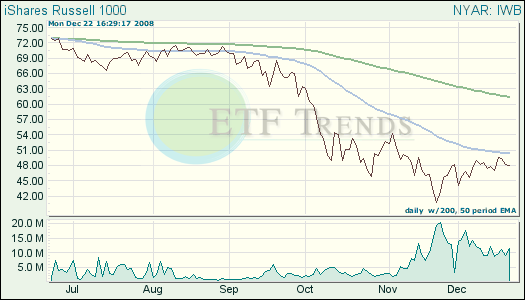

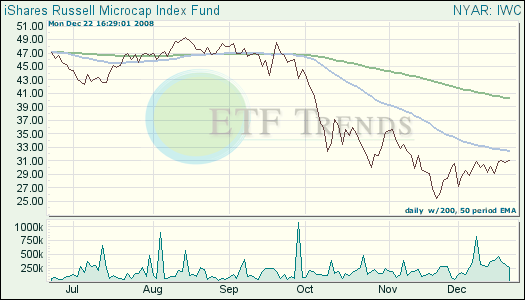

The smallest companies in the ETF world can best be represented by iShares Russell Microcap Index Fund (IWC), which is down 41.6% year-to-date, whereas the largest companies can be represented by the iShares Russell 1000 (IWB), which is down 40.4% year-to-date. Over the last three months, they’re down 36.3% and 29.7% year-to-date.

IWC has come close to crossing over IWB, but with the failure of Lehman, the Freddie/Fannie takeover, and TARP legislation, credit markets became tighter, especially for small businesses. Until the small company stocks break above large company stocks, it is difficult to say that we have made it half-way through the recession.

While watching these types of movements is interesting, the easiest way to see if we’re poised for a comeback is to watch those trendlines. While both of these funds are nearing their 50-day moving averages, they’re not quite there yet.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.