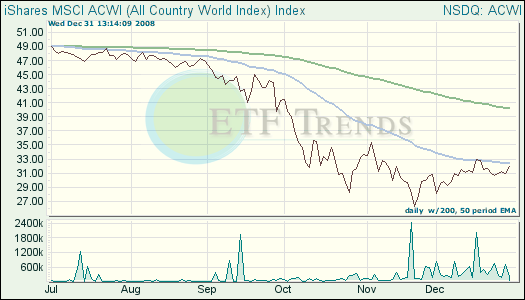

World markets are leaving 2008 deflated and disappointed after a year of volatility and uncertainty, leaving stock markets and exchange traded funds (ETFs) around the world ending on a flat note.

As of Wednesday, stocks in Europe and Asia have changed very slightly as the New Year’s Eve trade turned out to be short and modest, reports Pan Pylas for Associated Press. The FTSE 100 index of leading British shares closed up 0.9%, while France’s CAC-40 close up a bare 0.03%. Germany’s DAX, was closed for New Year’s Eve, as were markets in Japan, South Korea, Indonesia, Thailand and the Philippines.

For the United States, the stock exchanges look to be closing out the year with scarce activity and news of GM’s financial injection the only savior. So far today, U.S. stocks are continuing their moves higher.

The world’s main markets do not re-open until Friday.

- iShares MSCI ACWI Index (ACWI): down 22.2% year-to-date

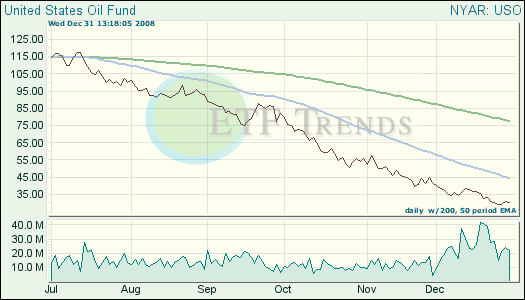

Oil closed out 2008 with the last trade at below $40 per barrel. This year has proven to be a wild ride for crude oil, one of the most volatile in history. Mark Williams for Associated Press reports that in just five months, crude has given up four years of gains in a stunning collapse as the world’s leading economies sank into recession.

Light, sweet crude for February delivery on New Year’s Eve rose 12 cents to $39.15 a barrel on the New York Mercantile Exchange. The contract overnight fell 99 cents to $39.03.

- United States Oil (USO): down 60.2% year-to-date

Unemployment is still in a state of distress, as the number of unemployed that continue to draw aid is rising, however, the number of freshly laid-off workers seeking benefits dropped last week. The decline does not signify an improved labor force, however. The drop is just a seasonally adjusted rate that reflects the Christmas season and those unable to make it to the unemployment offices, reports the Associated Press.

Economists expect claims to be at 4.38 million for those continuing and new jobless claims at 550,000, as many employers are trimming staff and cutting costs.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.