China and India’s economies had experienced a flourish of growth, only to come slamming to a halt, leaving the country’s leaders wondering if they are going to slide further down, taking their stock markets and exchange traded funds (ETFs) with them.

Not so long ago, both China and India felt immune to the global recession taking place all around them, and now that the dust is settling, they are fearing the reversal of fortune may be steeper than anyone could have anticipated. The Economist explains that the optimists felt that the two countries were the last hope for the global recession, that they were the engines that would pull us through. Now they are thinking again.

Although both China and India are important components of the world economy, they have their shadows to deal with. India has suffered terrorist attacks, and had once pulled itself away from Pakistan to step up with China as an economic powerhouse and become a success story.

China has lifted their economy and parts of the country with rapid growth, taking the transformation from farmland peasant to industrialized society in less than a decade. But the numbers don’t match up anymore and there is a massive scale of social turmoil amid the falling trade numbers, declining power generation and a stalled-out GDP.

The main points to watch during the fallout is China’s political reform against the economic change as well as India’s economic price for its democracy. China has the means and the money to pull through and help the rest of the world, however, India may not have any answers to the growing economic problem plaguing the globe.

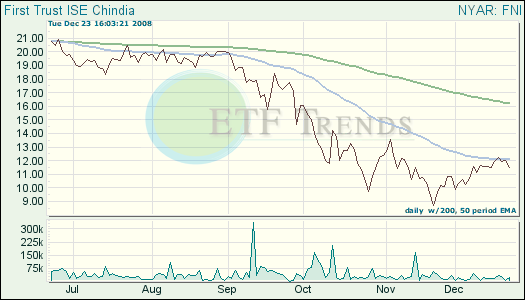

- First Trust ISE Chindia (FNI): down 61.6% year-to-date

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.