Billions are now slated to head to Detroit as of this morning, narrowly averting an even deeper economic crisis than the one that has already left the markets and exchange traded funds (ETFs) battered and wounded this year.

President Bush will give $13.4 billion in emergency loans to prevent a collapse of General Motors and Chrysler, report David M. Herszenhorn and David E. Sanger for the New York Times. Another $4 billion will be available in February, all from the $700 billion TARP fund. It’s not free money, though: the entire bailout is on the condition that companies undergo sweeping reorganizations.

The companies have until March 30 to meet the standards. By then, President-elect Barack Obama will be in office, and he’ll be under political pressure. If the companies haven’t struck the right deals, it would mean going to bankruptcy court and widespread layoffs. It’s been said that one out of every 10 workers is affected in some way by the auto industry, so a collapse would almost certainly be widespread.

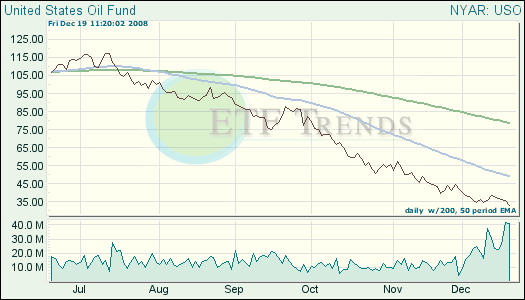

The markets continue to ignore OPEC’s production cuts, as oil dropped at one point to below $34 a barrel, reports Christopher Johnson for Reuters.

Goldman Sachs analysts say they believe the production cuts are unlikely to be fully implemented. OPEC President Chakib Kehlil said that he believes oil prices have found a bottom, however. Nearby U.S. futures contracts on oil are expiring later today, so there could be a lot of selling of January futures and buying of February or March.

- United States Oil (USO), down 56.8% year-to-date

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.