The recent auto bailout plan came to a sputtering halt after Republicans in the Senate refused to support a compromise, giving the markets and exchange traded funds (ETFs) the runaround.

One Bush spokeswoman stated they would prefer the markets determine the fate of the private firms, however, since these are not normal economic conditions, they are considering a other options such as using the TARP funds, reports Edmund L. Andrews and David M. Herszenhorn for The New York Times. The Treasury Department stated they would give short-term relief to the automakers.

Retail and consumer spending is also in need of an injection, as November brought bleak numbers, and the costs of goods continue to fall. Christopher S. Rugaber for the Associated Press reports that businesses have also cut their inventories by the largest amount in five years, another sign of the recession deepening and production cuts to push it to anther level.

November presented the fifth straight month for retail sales to drop, and they fell by 1.8% last month. Due to these record drops, production cuts are just around the corner. The Commerce Department reported Friday that businesses slashed the inventories they were holding on shelves and back lots by 0.6% in October, reports Martin Crutsinger for the Associated Press.

All levels of the supply chain are affected, but the largest cut was in wholesale at 1.1%. Despite retailers’ attempts to lure customers on Main Street, the sales are simply sluggish and the demand is not materializing.

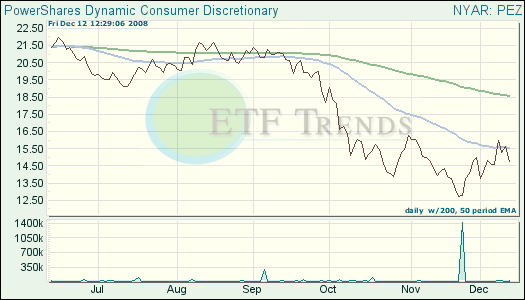

- PowerShares Dynamic Consumer Discretionary Sector Portfolio (PEZ): down 37.6% year-to-date

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.