Exchange traded funds (ETFs) surrounding pharmaceutical companies appear to be mixed up as findings from advanced drug studies pertaining to dementia are inconclusive.

Both Elan Corp. (ELN) and Wyeth (WYE) said complete data from the midstage trial of their experimental drug for Alzheimer’s disease supports their decision to move the drug into more advanced studies before a definite conclusion can be made, reports Shirley S. Wang for The Wall Street Journal.

The drug, bapineuzumab, had inconclusive test results that may not move expert scientists and investors. While it did show effectiveness in cleansing the brain of a substance many believe plays a role in the disease, patients on the whole showed no improvement in their symptoms.

Both companies decided to go on to Phase III, which can cost at least $100 million.

According to the Alzheimer’s Association, the disease is the sixth-leading cause of death in the United States, surpassing diabetes. At least 5.2 million people live with the disease, and 10 million baby boomers will develop it. The cost of treating Alzheimer’s and other forms of dementia exceeds $148 billion per year.

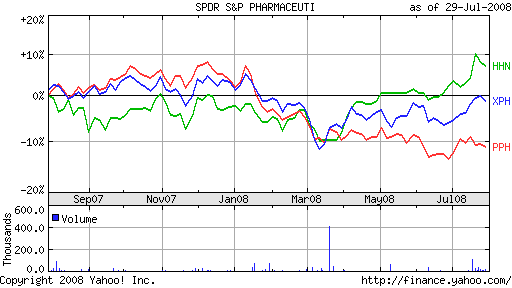

ETFs that could benefit if this drug ultimately proves to be effective in the treatment of this disease include:

- SPDR S&P Pharmceutical (XPH): down 3% year-to-date; Wyeth 4.8%

- Pharmceutical HOLDRs (PPH): down 13.3% year-to-date; Wyeth 7.5%

- HealthShares Neuroscience (HHN): up 9.2% year-to-date; Elan 6.3%

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.