While one sector and its exchange traded funds (ETFs) continues to see more of the downside, another sector is falling after more than a year of seeing nothing but the upside.

Real estate continued to take hits, with pending home sales sliding 4.7% in May, CNN Money reports. The numbers are now down 14% from May 2007, and the decline was even steeper than the 2.8% that economists were expecting.

Meanwhile, oil is so far continuing its second consecutive day of losses. Traders are taking profits and worries about supply are falling away, leading to a more than $8 two-day loss in early trading, reports George Jahn for the Associated Press.

Does that mean our troubles are over? Not so fast, says one analyst. It’s just a temporary correction that’s seen as a buying opportunity.

Oil investing legend Boone Pickens is sticking by his forecasts that oil will hang around $150 for now, but that it may fall to $100 in two years, CNBC reports. He also says the prices aren’t because of speculation – it’s supply and demand.

This is where things get dicey and perhaps a little emotional, but don’t forget your sell strategy. If you’ve been holding on to oil funds and making nice gains, protect what you’ve earned and be prepared to sell if they fall 8% off their highs.

Oil and oil-related ETFs are falling lower in early trading.

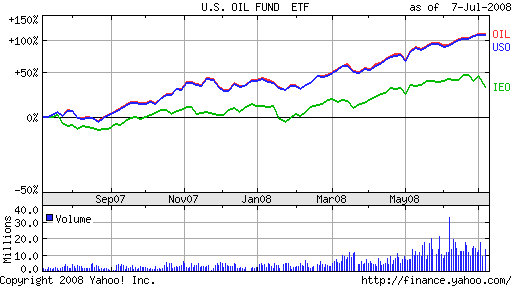

- United States Oil (USO), up 51.5% year-to-date

- iPath S&P GSCI Crude Oil Total Return Index (OIL), up 51.2% year-to-date

- iShares Dow Jones US Oil & Gas Exploration Index (IEO), up 18.7% year-to-date

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.